Recognizing the Expense Cost Savings of Medicare Benefit Insurance Policy

As people navigate the complicated landscape of medical care insurance choices, understanding the nuances of cost savings within Medicare Benefit plans comes to be progressively crucial. By diving right into the details of how Medicare Advantage intends attain these cost savings, people can get important understandings into enhancing their health care coverage while potentially decreasing out-of-pocket expenses.

Benefits of Medicare Benefit Plans

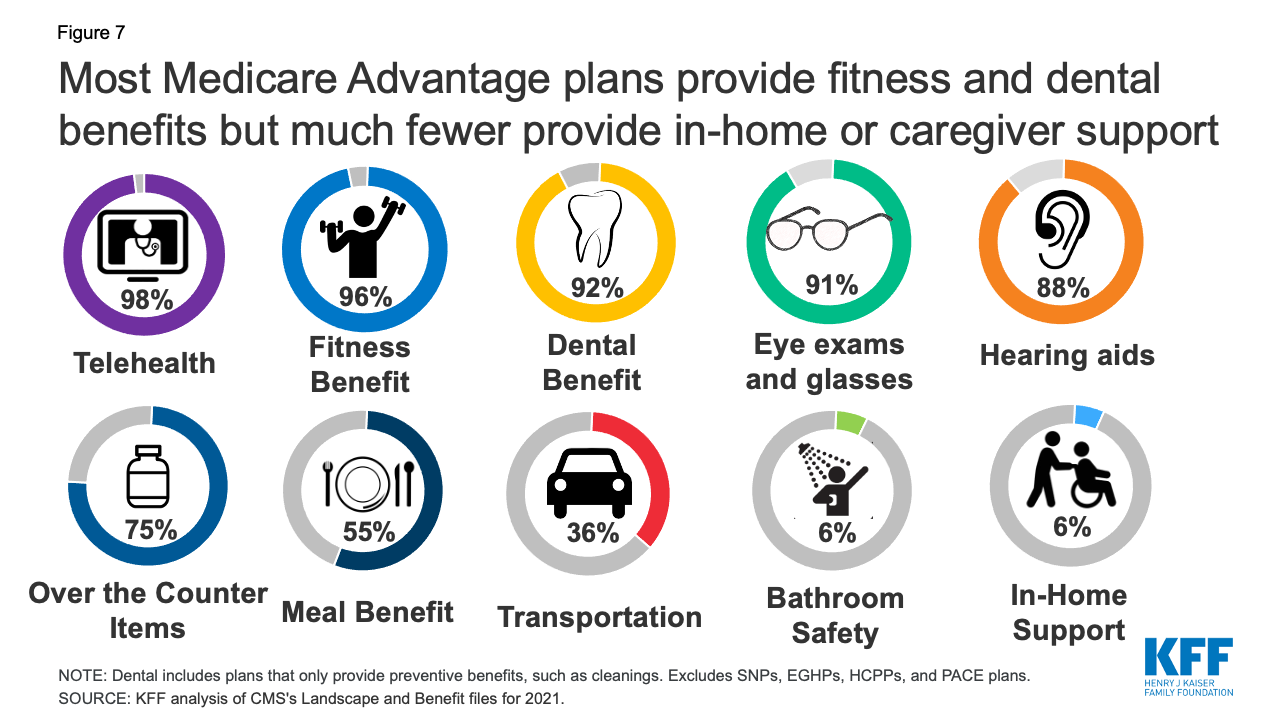

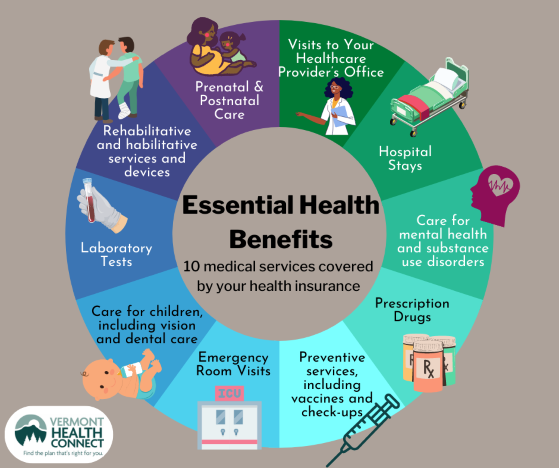

Medicare Benefit plans deal a thorough range of benefits that go beyond standard Medicare coverage, providing enrollees with improved healthcare solutions and cost-saving chances. These plans often consist of coverage for solutions such as oral, vision, hearing, and prescription medications, which are not usually covered under original Medicare. By settling these various health care requires right into one plan, Medicare Advantage beneficiaries can enjoy the ease of having all their medical services covered under a solitary plan.

In Addition, Medicare Advantage prepares often include added advantages like health club memberships, telehealth solutions, and health care to promote preventive treatment and total wellness. These value-added advantages aim to improve the high quality of treatment for enrollees while likewise assisting them reduce out-of-pocket expenses that they might otherwise incur with conventional Medicare.

Basically, the advantages of Medicare Benefit prepares extend beyond fundamental medical coverage, supplying an extra alternative method to healthcare that concentrates on preventative procedures, benefit, and cost-effectiveness for recipients.

Cost-Effective Protection Options

The enhanced advantages supplied by Medicare Advantage intends not only improve medical care protection yet likewise existing recipients with a variety of cost-effective coverage options to think about. These strategies typically include fringe benefits past Original Medicare, such as vision, dental, hearing, and prescription medicine coverage, all packed right into one extensive plan (Medicare advantage plans near me). By offering these added solutions, Medicare Benefit plans can assist individuals conserve money by lowering out-of-pocket expenses that would otherwise be sustained separately

In Addition, some Medicare Advantage plans have reduced month-to-month costs compared to standard Medicare, making them an appealing alternative for those seeking to handle their health care prices effectively. The cost-effective coverage options offered via Medicare Benefit strategies can supply recipients with thorough health care insurance coverage while potentially conserving them cash in the long run.

Possible Out-of-Pocket Savings

In Addition, Medicare Advantage plans often include extra advantages not covered by Initial Medicare, such as vision, dental, hearing, and prescription drug protection. By packing these services right into one detailed plan, recipients can save money on out-of-pocket expenditures that would certainly or else be sustained if they had to purchase here are the findings different insurance policy plans or spend for solutions expense.

Value-added Services and Advantages

Value-added services and advantages supplied by Medicare Advantage intends boost the general healthcare experience for strategy participants. These added services surpass what Original Medicare covers, offering extras such as vision, oral, listening to protection, fitness programs, and even prescription medication insurance coverage in many cases. By including these supplementary advantages, Medicare Advantage plans purpose to give thorough care that addresses not just medical requirements but additionally total wellness.

Additionally, some Medicare Advantage strategies may use telehealth solutions, which have actually become increasingly valuable in today's electronic age. This enables plan participants to talk to doctor from another location, saving money and time while making certain accessibility to necessary clinical focus. Medicare advantage plans near me. Additionally, lots of plans provide care control services, aiding members navigate the intricacies of the healthcare system and guaranteeing they receive proper and prompt care

Elements Affecting Cost Cost Savings

Variables affecting expense savings within Medicare Advantage plans are essential to comprehend for both suppliers and beneficiaries. Another aspect blog is the network structure of Medicare Advantage plans, which frequently have agreements with details medical care suppliers to supply services at bargained rates. Comprehending these factors can aid carriers and recipients make educated choices to optimize price savings while keeping quality treatment within Medicare Advantage strategies.

Conclusion